Customize and send invoices easily

Sending an invoice should be easy – and we’ve made it so.

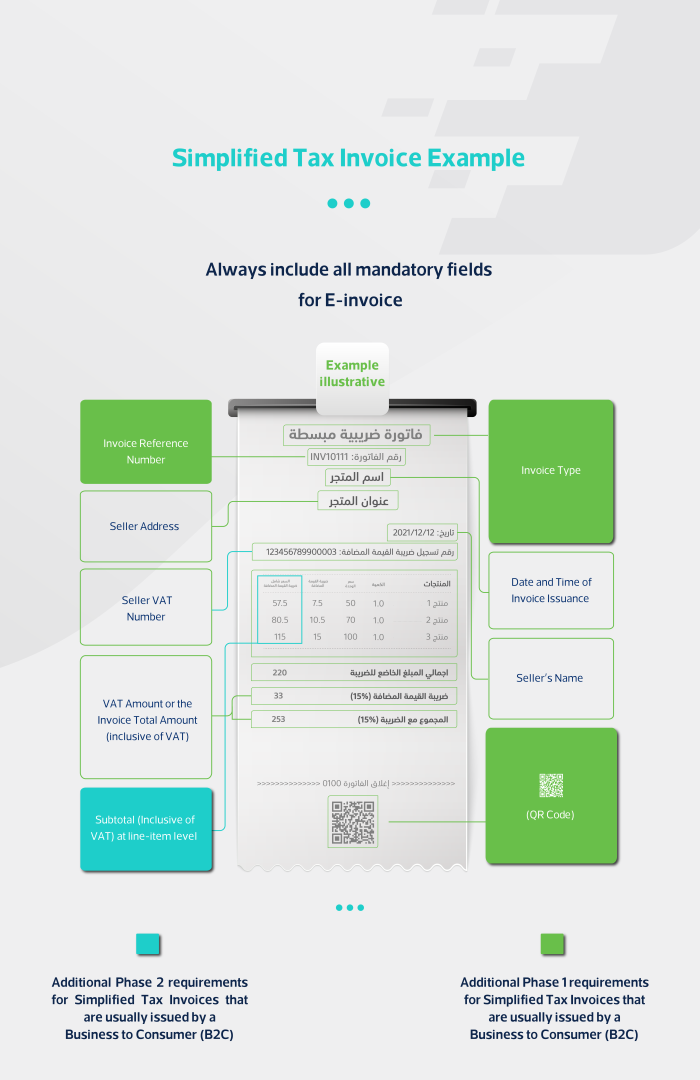

Compliant with Zakat, Tax and Customs Authority

Generate invoices fully compliant with ZATCA requirements

Invoice customization

Invoices tailored to your business needs and brand identity.

Compliant with Zakat, Tax and Customs Authority

Generate invoices fully compliant with ZATCA requirements

FEATURES

Item Management

Inventory Software gives you the complete control over your items with real-time stock visibility and gives you accurate view on items profits and margins.

Warehouse Management System

Warehouse Management System manages the inventory in warehouses and gives you the complete tracking control over your all warehouses.

Production System

Mtech's production system helps you to maximize your efficiency in complete production life cycle including wastes, expenses, finished goods etc.

Procurement System

Mtech has made it easy for every company to manage the procurement and it includes purchase quotation, purchase order, purchase invoice etc.

Sales System

Mtech sales system has made it easy to manage everything related to and it includes sales orders, sales invoices, sales returns etc.

Stock Management

You can manage all your stock with Mtech stock management tool and it includes stock transfer, stock adjustment, damaged stock etc.

Barcode Tool

Mtech has its own Barcode Tool to create barcodes with easy to use interface and Barcode Printing Tool helps you to print the barcodes in bulk.

Tax Setup & Tax Rates

Set your own tax rates on all your invoices and transactions. Mtech has full support for Value Added Tax (VAT) for GCC countries businesses.

Reporting

View, share and export more than 45 real-time data reports without any time constraint to analyze the business performance and efficiency.

ZATCA PHASES

Transition phase

The Zakat, Tax, and Customs Authority (ZATCA) in Saudi Arabia, through Phase I of e-invoicing, had mandated that all businesses must issue only e-invoices using compatible systems from 4th December 2021.

Integration phase

The Zakat, Tax, and Customs Authority (ZATCA) in Saudi Arabia, through Phase I of e-invoicing, had mandated that all businesses must issue only e-invoices using compatible systems from 4th December 2021.

Deadlines

Phase Il is rolled out in waves based on annual revenue subject to VAT. ZATCA will notify taxpayers at least six months in advance. Businesses with revenue over 10 million SAR must be Phase Il ready by 28th February 2025